- The Daily Rip India by Stocktwits

- Posts

- Paytm Turns Profitable!

Paytm Turns Profitable!

Tale of the Tape

Good evening, boys and girls.

Markets gained steadily throughout the day, with the Nifty (+0.6%) and Sensex (+0.7%) ending higher. The main indices mostly tracked global markets, which were upbeat over Trump’s trade deal with Japan. But India’s broader markets traded mixed, with Midcaps (+0.3%) up and Smallcaps flat.

The overall market breadth was positive, with 3 stocks rising for every 2 that fell. Except Real Estate (-2.6%) and FMCG (-0.5%), all other sectors ended in the green. Auto (+0.9%) and Banks (+0.8%) were the top gainers.

Today’s issue covers Paytm’s turnaround quarter, Jana Small Finance Bank’s weak Q1, GNG Electronics IPO, trading charts and more.

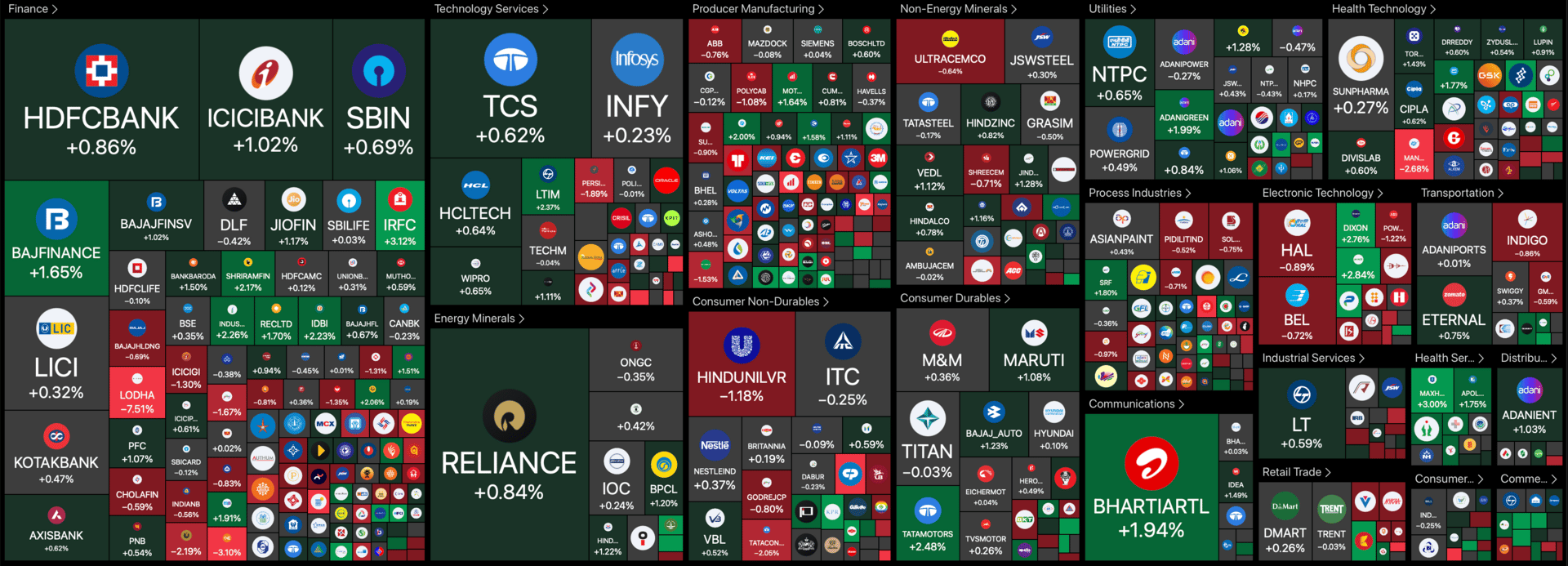

Check out the NSE500 heatmap:

Nifty | 25,061 | FLAT |

Sensex | 82,187 | FLAT |

Bank Nifty | 56,756 | -0.4% |

Earnings

Earnings Roundup

Paytm hit a new 52-week high on strong Q1 results. The big headline is that the company reported its first ever quarterly profit! FYI - technically it happened in September 2024 too, but that was due to a one-off gain from the sale of its ticketing biz.

But don’t let that distract from its turnaround story. Gross merchandise value (GMV) jumped +27% YoY to hit Rs 5.39 lakh cr. Average monthly transacting users was up +2% QoQ to hit 7.4 crore. Also, revenue from financial services business DOUBLED YoY, on the back of strong growth in merchant loan disbursements while payment services were up +18% YoY.

The other side of the story is a drop in indirect expenses (-30% YoY), helped by cuts in marketing, ESOP and employee costs. FYI - the bottomline was helped by a bump in other income (one-off tax refund), but it doesn’t take away from its efficiency gains.

Here are its Q1 stats:

Revenue: Rs 1,918 cr; +28% YoY

EBITDA: Rs 72 cr vs loss of Rs 783 cr last year

EBITDA Margin: 3.7%

PAT: Rs 123 cr vs loss of Rs 839 cr last year

Big Picture: The stock was volatile AF! mostly cause it gained +13% over the last month in anticipation of good results. Paytm also guided for profitability this quarter, so it was more about meeting expectations. That said, it did get a bunch of bullish brokerage calls. Jefferies upgraded the stock and hiked its target price to Rs 1,250 p/sh (vs Rs 900 p/sh earlier).

Paytm is +9% YTD.

What’s your view on the stock? |

Jana Small Finance Bank (-8%) Q1 results missed Street estimates. Higher operating costs + lower net interest margins weighed on the company’s lending income even though it reported a +15% YoY jump in advances. FYI - the lender also saw a nice bump in other income (+41% YoY), but despite this its net profit still fell. Yikes. Asset quality also deteriorated, even though provisions were largely unchanged YoY.

Here is its Q1 report card:

Net Interest Income: Rs 595 cr; -2% YoY

PAT: Rs 102 cr; -40% YoY

Gross NPA; 2.91% vs 2.71% last quarter

Net NPA: 0.94%; unchanged

Big Picture: After a rough FY25, this was the last thing anybody hoped for. Margins should recover after the RBI’s rate cuts are passed onto customers. But something is clearly going wrong operationally, with expenses rising +22% YoY. We’ll have to see if things turn around.

Jana Small Finance Bank is -30% over the last year.

Stocktwits Specials

What Next For Ola Electric?

Ola Electric has been in the news for all the wrong reasons lately. The stock is down -70% from its all-time high but is the worst behind us or is there more pain in store? Find out as we break down the company’s pros & cons, fundamentals and technicals in our latest video.